The truth about Salesforce Enterprise License Agreements (SELA)...is it right for you?

We’ve found that the average savings potential for a company switching from a Salesforce Enterprise License Agreement (SELA) to a standard Salesforce Subscription Agreement is 41.3%.

Yet many large enterprises still honor their SELA agreements simply “because we’ve always had one.” Subsequently, these companies have a difficult time benchmarking the value they’re extracting from a SELA vs any other contracting method.

While Salesforce will present these agreements in a way that may seem extremely advantageous to the customer, the truth is they’re rarely a good fit.In this article we are going to explain:

- What is a SELA Agreement?

- How SELA’s looked in the early days of Salesforce

- How present day SELA’s have changed

- Why SELA Agreements are a bad idea for most companies

- Problem 1: SELA caps are built off of your current needs

- Problem 2: SELA agreements are manipulated by Salesforce’s changing product line

- Problem 3: You are paying 41.3% more than you should be with a SELA Agreement

- When SELA’s work

- When SELA’s don’t work

- Why “you don’t have to manage it” rarely justifies a SELA

- What to do if you have a SELA

What is a SELA Agreement?

A SELA Agreement is a Salesforce Enterprise License Agreement.

What is the difference between a Salesforce Enterprise License Agreement (SELA) and a Salesforce Subscription agreement?

A Salesforce Enterprise License Agreement (SELA) agreement is different from a Salesforce Subscription Agreement in one key way. A SELA is meant to provide “Unlimited Access” to the platform, while a standard Salesforce Subscription Agreement includes set prices for a set number of products.

Yet while SELA began as an “Unlimited Access” promise, that is not quite what SELA agreements look like today.

To understand SELA’s and why your company probably doesn’t need one, it’s helpful to understand the history of SELA’s and how they may have looked when your company originally signed one.

How SELA’s looked in the early days of Salesforce

In the early days of Salesforce, there was a massive focus on market penetration. Like any typical SaaS company, all they cared about was volume.

In the early days of Salesforce, the CRM market was extremely fragmented with small players and disparate homegrown solutions. Arguably, at the beginning, the largest competitor to Salesforce was Microsoft Excel. As a result, Salesforce hit the market precisely at the right time and acquired new customers relatively easily.

But given that Salesforce was in such a high-growth mode, they wanted to leverage their existing client base to grow organically both internally and externally at the client organization. In other words, they wanted to pursue any strategy that enabled new endpoints whenever, and wherever, possible.

Under this premise, they created the first SELA which conceptually provided unlimited access to the platform. This would ensure that Salesforce could land and expand as fast as possible within a new account without any barriers, paperwork, governance, or red tape.

The MO of an early SELA deal summarized would be:

Your contract with Salesforce is $10M per year over a 5 year contract term. It is a $50M relationship, and you can use the entire Salesforce platform however you see fit, no restrictions. Use our support as you need it. Our goal is to help you grow.

This unlimited access approach was the foundation for Salesforce’s growth by 100x in the early years. By signing one of these deals, and then expanding into a large enterprise organization, they were able to show massive growth rates on all of the SaaS growth metrics such as users, retention, growth rate, turnover rate, etc.

Because they were signing customers onto SELA’s, their growth metrics went through the roof which gave all of the signals for additional funding, press, and market share.

The goal of SELA in the early days was simple. Achieve as much penetration as possible into the corporate world.

How present day SELA’s have changed

While SELA’s once provided “Unlimited Access” to the platform, that isn’t always the case today. Present day SELA agreements look quite different.

Today’s SELA Agreements are full of floors and caps on the quantity of specific product sets that you can use. While old agreements were “Unlimited”, the new agreements come with added restrictions, usage ceilings, and massive financial growth commitments.

When your organization grows/declines past the commercially allowed threshold within your specific SELA, there will be significant financial consequences. Subsequently, without the proper legal terms and conditions protecting you from changes within your business, you are setting yourself up for significant financial and legal risk.

Why a SELA is a bad idea for most companies

A floor/cap on your product usage initially may not sound like a large risk for your company, especially if you are comfortably within the allowed threshold at the time of contract execution. That being said, there are 3 major problems that commonly arise from this scenario. Here we are going to dive into the three fundamental problems:

Problem 1: SELA caps are built based on your current needs

A SELA agreement will often be on a 3-5 year term, and the caps are negotiated based on the needs of your organization at the signing of the contract. This may not sound like a major risk, but for high volatility (growth and/or decline) companies, or anyone in an active M&A industry, this can be a major issue.

When you break the caps of your SELA Agreement, it’s not as simple as “buying extra licenses” to make up the gap. Instead, it will trigger an entire sales event with Salesforce that is going to have them coming back to you for more money.

Additionally, you may only trigger your cap in one single product category (Ex. Pardot), but if you break your SELA caps in that space, they can use that as grounds to raise prices across the board.

These caps are dangerous because as soon as you break one, it puts the power of the contract back into Salesforce’s hands.

Problem 2: SELA Agreements are manipulated by Salesforce’s changing product line

The second problem with a modern day SELA is the ever-changing product line from Salesforce.

Salesforce is a master of releasing and repackaging products. They are constantly rolling out new products into the market, as well as repackaging existing products, while retiring old products.

While innovation at Salesforce is great, the new products and services that are organically (or inorganically) created are rarely contemplated as part of your organization’s SELA. If your organization wants to use those new products and/or services, they will likely need to be paid for separately as an additional expense.

Additionally, some products may “retire” or become a “carveout” of an existing product. Continued usage of these products may actually trigger a contractual breach of your SELA.

This sounds ridiculous, but Salesforce does it all of the time, and it’s very expensive for the client. Naturally, most Salesforce clients are not aware of these inherent risks until they’re sent an invoice for this incremental out of compliance usage.

Here is a recent practical example of how they pull this off...

Repackaging Example: Sales & Service Cloud

Up until recently, Sales Cloud & Service Cloud were two separate products from Salesforce.

Sales Cloud was for Sales Reps while Service Cloud was for service department technicians. These two products came at two different price points. Sales Cloud was cheaper, and Service Cloud was more expensive.

Eventually, Salesforce decided to roll these into “Sales and Service Cloud” as a single commercial product even though they technically operate as separate infrastructures (clouds). This provided Salesforce a commercial opportunity to financially uplift those existing clients that had both products (Sales and Service Cloud), historically with two different price points, now as a single price point that matched the more expensive line item as part of Customer 360. The logic being that both clouds are integrated harmoniously whereas the entire client organization is able to review all of its omnichannel touchpoints with their customers. This “additional value” was largely the basis for this product and price convergence.

The targeted outcome is typically around a 30% revenue boost within the existing customer base. This revenue boost was predicated by a simple repackaging of services.

Problem 3: You are likely paying 41.3% more than you should be with SELA

We renegotiate a lot of SELA deals at The Negotiator Guru (TNG), and on average, we identify a 41.3% cost reduction opportunity when switching to a standard Salesforce Subscription Agreement.

The reason behind this is that most SELA’s are priced extremely high (on a price per unit, per month basis) and commit the client to much higher usage (products & quantities) than is actually being used, creating conceptual shelfware.

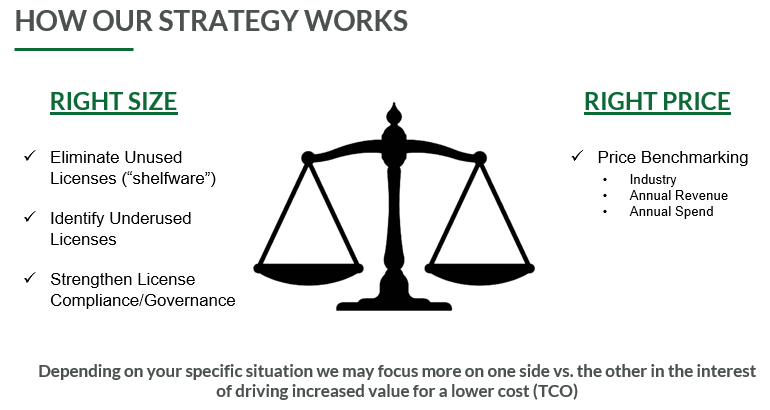

At TNG, we leverage a proprietary Right Size, Right Price approach to drive efficient and long lasting savings for our clients.

We first understand what your organization actually needs and build a roadmap to support you based on your specific global business. Instead of buying everything through a SELA Agreement, we leverage our Right Size framework to ensure you’re leveraging the appropriate products and services at the Right Price.

We are able to easily identify Right Price information based on our industry leading price benchmarking database that is minimally rationalized based on your Annual Contract Value, Industry, and Company Size. We say “minimally” because there are other factors that determine product pricing such as product mix, your roadmap, Salesforce quarterly interests, etc.

Then, we leverage our unmatched expertise negotiating with Salesforce either as a covert silent advisor, or an overt legal agent, to extract maximum value for you at the lowest possible cost.

Those two simple components alone have generated our SELA Agreement customers 41.3% in savings.

We’ve worked with Fortune 100 companies paying $25M+ per year to Salesforce whose actual contract value should have only been $10M.

The savings potential is real and worth the time to renegotiate.

When a SELA is a good idea

Most of this article is spent sharing why SELA’s are a bad idea for most clients. That being said, there are a few select cases where they may be temporarily beneficial to a client.

Every year, we speak with hundreds of Salesforce Customers. Since the inception of TNG in 2015, we have only had one customer where a SELA was actually a good fit for their needs.

While we always keep our clients confidential, this specific company was a high-growth IT firm with rapid-growth aspirations (500x), large amounts of equity funding, minimal IT resources, and a technical architecture that required Salesforce to act as the backbone for their outreach strategy. They were in a very unique situation.

Here are the required conditions to even consider a SELA:

- High-Growth Environment of 10x-500x per year;

- High-amounts of capital investment;

- A large volume of customers with varying interaction levels across multiple channels; or,

- A clear architectural roadmap from a digital capability and functionality perspective.

When a SELA is a bad idea

99% of the time, a modern day SELA Agreement is a bad idea. In almost all cases, it just doesn’t make sense.

Here are (only some of) the conditions where a SELA does not work:

- You signed a SELA 4+ years ago;

- Your company has predictable needs in both products and quantities;

- Your company is spending less than $10.75M/year on Salesforce;

- You have less than 5,000 API connections per day;

- Your IT department’s strategy is to leverage native (vs. custom) functionality wherever possible;

- You have less than 3,500 Sales and/or Service Cloud licenses; or,

- You’re not sure where your business is going in the next 3-5 years.

Why “you don’t have to manage it” rarely justifies a SELA

Yet, even with everything we shared, many companies still sign up for new, or keep renewing their existing, SELAs. Perhaps that’s because they haven’t read this article!

The most common reason we hear from our clients on why they have a SELA is that “We don’t have to manage it. There are no order forms, compliance, or governance. We just signed the deal and originally, didn’t have to worry about it.”

While that is great in theory, you can achieve nearly the same benefits with a standard Salesforce Subscription Agreement by negotiating specific terms and conditions into your Order Forms. We will share two of these terms below for your awareness and utilization:

M&A Language

Request language be added to your Order Forms that protects you in the event of an extraordinary corporate event like Merger and Acquisition (M&A) Activity. Adding in the appropriate language for M&A activity can provide huge benefits to your organization. Specifically, ensuring that an acquisition or divestiture can be brought in or taken out of your environment without commercial recourse will proactively avoid painful legal headaches and financial synergy slippage.

Product Swap Language

As we discussed, Salesforce likes to change up their product line to create disruption in the marketplace and in your contract. Introducing product swap language that enables you to swap products and services freely as long as you maintain the same annual contract value provides a huge value that is similar to that of a SELA.

FAQ’s

What happens if I exceed the caps on a product in my SELA Agreement?

Salesforce will use this overage as leverage against you in your upcoming negotiation. They will either charge you an overage fee or push a net new product on you in exchange for waving your overage fee. This net new product helps them achieve additional revenue, new products, and a larger footprint inside of your organization.

When you exceed the caps on a product in your SELA Agreement you are naturally placing yourself in a vulnerable position with Salesforce.

Many organizations who have an active SELA Agreement with Salesforce don’t have an internal software asset management (SAM) team. As such, these organizations won’t know they have exceeded their cap limit until Salesforce informs them. Even with an active SAM team inside multinational organizations it can be very easy to exceed your caps.

In general, 6 months prior to your contract renewal, Salesforce will conduct an audit on your account to look for any overages. If your organization is not already aware of these overages you’re naturally going to be on your heels trying to fact check information internally. Either way, Salesforce will use these overages as leverage against you in the upcoming renewal negotiation.

There are two scenarios that commonly play out within this situation:

First, if you notice you have exceeded the cap limit, you can take corrective action to decrease your quantities of specific products so that you are back in compliance. Your organization will technically be obligated to pay overage fees for the time those overages were occurring within your environment. The standard language within Salesforce agreements indicates you will be liable to pay the “published retail rate.” In other words, the rate that Salesforce publicly publishes on their website without your organization’s discount.

Second, if Salesforce notices that you have exceeded the cap limit, then you will be hit with a heavy overage fee in a similar manner as discussed above. However, Salesforce will likely use this opportunity to push new products within your environment in exchange for some of the overage fee. The net outcome, if not properly negotiated, will be a higher total cost of ownership over the term of your new contract than paying the overage fee by itself.

It’s important we state this again: Standard Salesforce MSA and SELA Agreements (aka all agreements) include a standard clause that any license overage will be charged at the then current retail price. That means instead of paying for additional seats at your discounted rate, they will charge you the retail price for the product that is currently listed on their website.

This is a very dangerous situation as the retail price can often be 2 -3x your standard rate.

We recommend negotiating specific contractual language that limits your financial liability to that of your organization’s reduced rate vs. retail.

How do you approach negotiating an existing SELA Agreement?

When renegotiating a SELA Agreement, we leverage our best-in-class and proprietary approach that we always use when Negotiating with Salesforce.

Mastering Your Salesforce Spend: Why Ditching the SELA Can Save You Millions

Create a Salesforce Roadmap

The first step in controlling your Salesforce spend is to build a roadmap of specific products and services you will need from Salesforce over the next 5 years. Create a list of both your needs and your wants.

With a Salesforce Enterprise License Agreement (SELA), it is very important that you build a 5-year game plan instead of a 1-3 year plan. The reason is that the 5-year roadmap will help you decide if a SELA agreement is right for you. If you are forecasting rapid growth or large M&A activity, then a SELA may make sense, assuming the proper legal terms and conditions are in place. But without either of those two components, a SELA rarely provides the differentiated and intrinsic value one would expect from its large price tag.

In most situations, a SELA Agreement will not make sense for most organizations. Putting together a Salesforce Roadmap will help you see this clearly. When you have a clear roadmap of what products you need, in what quantities, then you can use that as a benchmark on price.

Benchmark Your SELA Spend with Right Price Data

Once you have your roadmap, the next step is to gather Right Price Data for what rates you should be paying for each product on your roadmap.

At The Negotiator Guru, we have the largest database of Salesforce rates as a result of reviewing hundreds of Salesforce contracts for organizations that span literally every industry. We can tell you what you should be paying for each product or service.

While firms out there like Gartner can provide directionally correct information, they are not able to provide prescriptive insights for your specific situation. To access our Right Price Data for your account, contact us at info@thenegotiator.guru.

When you take this Right Price Data and line it up against your roadmap, you can see an estimation of what your Salesforce spend should be in a total cost of ownership view. Now simply take that total number and compare it to the annual spend of your SELA Agreement to see just how much of a savings potential is available for your organization.

Based on our real client data, we find there is typically a 41.3% opportunity available when switching from a SELA to a standard MSA & Order Form contract and pricing structure.

Examples of SELA Negotiation Success

Through our work at The Negotiator Guru, we have helped hundreds of organizations reduce their Salesforce expenses. Our firm is the industry-leading expert in negotiating with Salesforce.

Here are two recent examples of SELA negotiations we have completed with, and for, our clients. All company information has been redacted for client confidentiality.

Negotiating a $75M SELA Agreement down to $32M (57% savings)

One of our clients came to us with a 3-year term on a SELA Agreement valued at $25M per year. This was a total contract value of $75M over a 3-year period.

We worked with the client to create a Salesforce Roadmap and shift the organization over to an MSA & Order form contract and pricing structure. This simple shift produced a material reduction of their annual spend down to $10.7M per year for a 3-year term.

That is over 57% in savings and $43M in cost savings over a 3-year period. This example shows just how much SELA Agreements can be overpriced.

$30.5M in savings by negotiating a SELA Agreement that no longer made sense post-M&A

This particular organization was on a 5-year SELA Agreement. The SELA was designed based on the company footprint at the execution of the SELA Agreement.

There was one major problem—this specific organization was in the telecommunication industry which was experiencing heavy disruption. As a result of this disruption, the company divested several business units for financial and regulatory reasons. When these business units were divested, everyone assumed that their Salesforce contract would adjust accordingly… but that was not the case.

The response that came back from Salesforce was essentially, “It won’t be possible to reduce your spend because you have committed to this agreement for a total of 5 years.”

This meant that the telecom organization was now paying for products and services that were used by companies they divested, and they were committed to continuing to pay for those products for an additional 3.5 years. In total, this would be $36M in wasted expense over a 3.5-year period.

Through negotiations with Salesforce, we were able to reduce that down to a $5.5M breakup fee for a total savings of $30.5M over a 3-year period. This example shows just how important it is to structure in proper M&A language into your SELA and all Salesforce Agreements.

SELA Agreement Logistics and Strategy

What is the typical SELA annual spend?

The typical customer on a SELA agreement is a multinational organization doing over $10B in annual revenue with a total spend of $15M+ per year with Salesforce.

How long does the process take to renegotiate a SELA Agreement?

The process to renegotiate a SELA Agreement typically takes 2.5 months. That being said, to properly prepare for the negotiation, we engage our clients a minimum of 6 months prior to your natural renewal date. Remember, 80% of negotiation is done through thoughtful and intentional planning. In a best-case scenario, you want to plan for your SELA renewal 1 year in advance.

Who is involved in a SELA Agreement negotiation?

On your organization’s side, the following individuals should be involved in your core negotiation team:

- Head of IT Sourcing

- IT Leadership in charge of the Salesforce Platform

- IT Finance Representative

- CIO (Optional)

From The Negotiator Guru, the following individuals are involved:

- Lead Negotiator

- IT Architect

- Legal Representative

Do I need to switch off a SELA or just negotiate a lower price?

In most cases, it will make sense for you to switch from a SELA Agreement to a standard MSA & Order form agreement with Salesforce. While you do not have to switch, it is often the most advantageous for you as a customer of Salesforce.

There are several material reasons for this, however, the most prominent being that it’s very difficult to proactively measure the value you’re receiving from Salesforce when everything is bundled into an annual fee. This lack of transparency is by design from Salesforce, allowing your account team to do some creative accounting.

When you convert to an MSA & Order Form contract structure, you can compare your specific needs with Salesforce directly with our Right Price Data to understand exactly what you should be paying.

My company’s workflow is seasonal, and a SELA allows us to adjust licenses as needed. How do we accomplish this with a Salesforce Subscription Agreement?

You can achieve the same flexibility of a SELA by adding in Seasonal Worker Licenses within your subscription agreement. These licenses largely produce the same flexibility as they are intended to be used for seasonal contingent workers that increase and decrease throughout the year. Another common use for these licenses would be for college interns or factory workers.

In some cases, Salesforce will tell their customers that this product option does not exist. This is simply not the truth.

Recently, one of our customers did not believe that a “seasonal worker license” actually existed. Through multiple conversations with Salesforce, he was told this simply was not an option. We pulled up a screenshot of another client’s invoice, redacted all of the confidential information, and shared the invoice with “Seasonal Worker License” as a line item. The client was blown away. You can achieve a Seasonal Worker License... you just have to ask... perhaps more than once.

More resources

From Fortune 500 giants to fast-growing innovators, TNG has helped clients save 20% – 40%+ on enterprise software contracts — even when they thought it was impossible

My 3 Guiding Principles for The Negotiator Guru

Imagine you are a C-Suite executive and your business is built on a franchise model.

Each franchise branch is owned and managed by a different person but they all use the same ERP and the big corporate umbrella entity that you own pays for all the services.

The individual owners dictate which software and services they use, how many licenses they need, etc.

Your annual bill for all the different contracts comes to $2.5 million.

How would you feel if I looked through your contracts and told you that, based on the prices your peers pay, you should actually be billed closer to $900,000 - a more than 60% savings - for the same host of services?

You’d probably want to flip the table we’re sitting at.

I started The Negotiator Guru because I believe in 3 things:

- Clients should all pay the same price for the same product*

- Clients have the right to know what rates they should be paying in comparison to their peers.

- Clients should know what to look for in software contracts to eliminate potential issues before they arise.

I want to go into each of these beliefs in more detail and give some case study examples to further demonstrate why I think these points are so important.

Clients should all pay the same price for the same product.

It’s common for people to believe the price they’re paying is equal to what their neighbor paid for the same product.

Due to both Master Service and Non-Disclosure Agreements between most software vendors and their customers, companies are not allowed to publicly share what rates they’re paying for their different products/services. Subsequently, software suppliers will almost never advertise a specific price point for enterprise customers but rather indicate “call for details” in the interest of driving the most revenue from the potential relationship.

In other words, in the art of enterprise SaaS sales, you won’t find any published rate information for you to benchmark your contract against. The only way for you to identify whether or not your rates are competitive is to engage a firm that holds that market intelligence as a result of analyzing contracts on a daily basis.

The fact of the matter is: Prices always vary.

No one pays retail as an enterprise customer but some companies achieve significant discounts compared to other similarly-sized operations.

In some cases, you’re getting ripped off if you’re not getting an 80-90% discount off published prices.

It wouldn’t be logical to expect a huge company like Coca-Cola and a small startup to be paying the same price purely based on volume alone. But brands of the same size with similarly-sized contracts (based on annual revenue & annual spend for their contract) should be paying the same price.

I have great respect for wonderful sales executives who sell value to customers, but my company believes the market should dictate a fair price for all IT goods & services (Services, Software, Hardware, etc).

The enterprise sales executive is arguably the greatest asset these IT companies have within their organizations. The good ones truly know how to sell “perceived” value.

Regardless of how personable a sales executive is, we believe the market should dictate what a fair price is - much like buying or selling a home. In order for this work, we believe that rate information should be readily available to customers. In order for this information to be shared legally, we need to enter into a commercial agreement with your company and charge for these advisory services.

Clients have the right to know what rates they should be paying in comparison to their peers.

On a daily basis we see similar-sized clients with similar-sized contracts have a 30 – 60% price variance.

Now, whether this is because some companies didn’t have strong negotiating skills or perhaps they just didn’t know how their contracts compared to the market doesn’t matter. What does matter is that clients know how their contract prices compare so they can make future decisions accordingly.

Ideally, through access to more information regarding IT contract pricing, you’ll be able to secure the best rates for your company. Leveraging this information can significantly impact a company’s bottom line.

But even if you aren’t able to achieve best-in-class pricing, we believe you should know what those rates are to empower decisions on how to work that supplier moving forward.

Often, relationships with IT suppliers run into the roots of your business and once you’re in that deep, it can be hard to break loose to find another vendor.

Even if you can’t get off of a big platform like Salesforce, Oracle or another ERP, you can make better-informed decisions about how you’re going to increase or decrease your use of that platform in the future.

There are a few market intelligence firms out there that supply basic and watered-down pricing information to clients but require a $30,000 per year subscription fee (per seat). This cost to have access to this benchmark data isn’t a feasible or justifiable expense for many companies.

We don’t feel that only Fortune 500 companies should have access to market intelligence firms and benchmark data.

The existing methods used to decide what the best price really is for any given enterprise could be improved. Most market intelligence firms take a general approach to setting correct pricing rather than looking at the specifics of each contract and the unique needs of each company.

For example, these firms will recommend that you should be getting a 60% discount if you’re spending $1 million with a particular IT company as a blanket rule.

Instead, we take into consideration the specific needs of our clients and use a Right Size, Right Price approach within every contract negotiation.

Clients should know what to look for in software contracts to eliminate potential issues before they arise.

Having a deep understanding of the terms of your most expensive contracts will help you save hundreds of thousands of dollars.

Here I want to briefly outline a few common contract issues that I see my clients face:

Price Protection (and not just by SKU)

Price protection generally comes up when you’re signing your first contract with a software provider. IT companies will compete for your business by offering you the lowest prices for their services with the expectation that they’ll be able to raise the rates once you’ve completely adopted the product.

Companies will always try to find ways to increase your annual expense. This is largely due to sales incentive plans in place with their sales development organization. Common tactics used by software companies include random internal audits to monitor usage (overage fees), product lift and shift changes (new SKUs), and service fees (for enhanced customer support).

More often than not our clients are very astute individuals that use their best efforts to price protect their organization’s contract for future years. That being said, it’s unrealistic to think anyone knows how to mitigate all the potential risks unless you do this everyday.

For example, to mitigate against the software companies from simply changing product names (SKUs) to bypass any preexisting price protection you may have on a specific product, we suggest you introduce contract language that protects your company using your total spend (vs a product-specific SKU) as the common denominator.

M&A Language

Make sure you have specific language in your contract about what happens in the case of a merger or acquisition.

Be sure to include language about a Termination for Convenience. This is a provision allowing you to get out of the contract if you acquire, or are acquired by, another company within a certain time frame - usually 90 days to 6 months.

Termination for Convenience eliminates the risk of having duplicate service providers for the same service after the transaction is closed. Without this stipulation, companies can find themselves with millions of dollars in expenses that are avoidable.

Note: In the interest of this article’s brevity we aren’t going to stipulate all the protections you need in an M&A transaction as this will be further explored in a future article. While the guiding principles of what to include within your contracts will remain consistent, client-specific protections will always require advisory services.

Termination for Breach

Termination for Breach language is important information to include in your contracts. In these cases, attorneys have to be involved and mal intent has to be proven by the accusing party.

This rarely ever happens and having the language laid out in the contract incentivizes IT companies to behave their best throughout the contract term.

License Limitations

It’s common to have language surrounding license limitations in your contracts. This basically says that you can use a specific license at a specific site for a specific reason.

These stipulations probably make sense on the surface and won’t alarm the person reading the contract but in most companies, with thousands of employees, not everyone is reading the contract. This could lead employees to inadvertently infringe on how the license may be used.

The best way for most companies to avoid this is to have seat-based pricing attached to specific personas (usage rights) rather than volume-based pricing.

Audit Rights

We’ll go into this further in a future article but I want to point it out here that you should be in control of the audit capabilities - don’t leave that in the hands of the supplier.

When IT companies retain audit rights, they have a Trojan Horse to get inside your company and find more ways to increase your pricing. They already know more about your company than you do - don’t give them the reigns to take over completely.

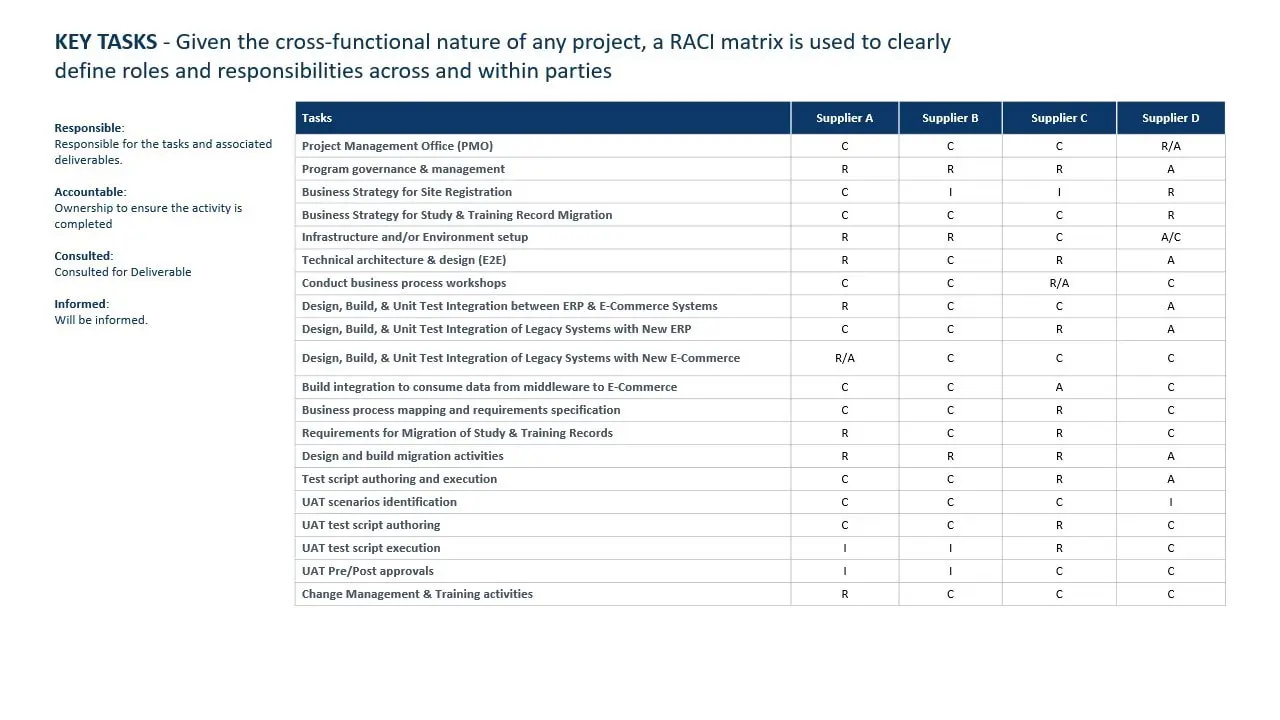

Roles & Responsibilities (when working with multiple parties)

Establishing clear lines of accountability is incredibly important when you’re working with multiple third parties.

As the owner of Company ABC, you’ve got Supplier X and Supplier Y. In each contract where there are dependencies for another supplier to take action, you will want to include a Roles & Responsibilities Matrix so that all parties are contractually agreeing to the same responsibilities/accountabilities. Conducting this exercise is not only a good way to align parties prior to the start of any project but also contractually protects you from any finger pointing across these same parties which will ultimately cost you time and money.

This Roles and Responsibilities matrix is oftentimes called a “RACI” Matrix - Responsible, Accountable, Consulting, Inform. The example below shows how it is used to clearly define roles and responsibilities across and within parties.

You can clearly see the task at hand, who is responsible for it, who is accountable for it, who needs to be consulted for it, and who is informed by it. Where appropriate we suggest including your internal resources as well as more often than not your suppliers will require your team to take action as well. Our clients use the RACI matrix process within their internal organizations as well to drive alignment and avoid potential issues before they arise.

From a tactical perspective, it’s important that the same RACI matrix is included within each supplier’s contract so that everyone is operating from the same table, terms, and conditions. This often takes some negotiation but with the proper foundation and alignment, you shouldn’t have any pushback from your suppliers. In fact, if you do have a supplier that is heavily pushing back against this exercise we recommend our clients view this as a potential leading indicator for what’s to come with that particular relationship.

With these 3 guiding principles, we ensure our clients are negotiating the best contracts for their needs.

Whether you’re in the process of negotiating your first IT contract or are looking to save big on your next renewal process, we’re here to share our experience and expertise with you.

We want to ensure that you’re paying the right price for the right products.

We want to make sure you have benchmark data to help you make decisions about the future of those contracts.

We want you to avoid contractual pitfalls by including key language around important, often overlooked points.

The Difference Between Gartner & The Negotiator Guru

Gartner, at its core, is a market intelligence firm. It uses a wide-angle lens to give you a big-picture view of market and industry trends. You can use their data as general negotiation guidance and add their toolkits to your own.

There is absolutely value in this broad-stroke model but it can be limiting when it comes to looking for data and resources that more specifically mirror the size and needs of your organization.

In this article, I want to outline the similarities and differences between a simple market intelligence firm approach and a niche service provider approach. There are many reasons you might want to research best practices from a 30,000-foot view as well as dive deeper at a 5,000-foot view.

Many of my clients will use both Gartner’s and The Negotiator Guru’s (TNG) services to achieve the best results for their companies.

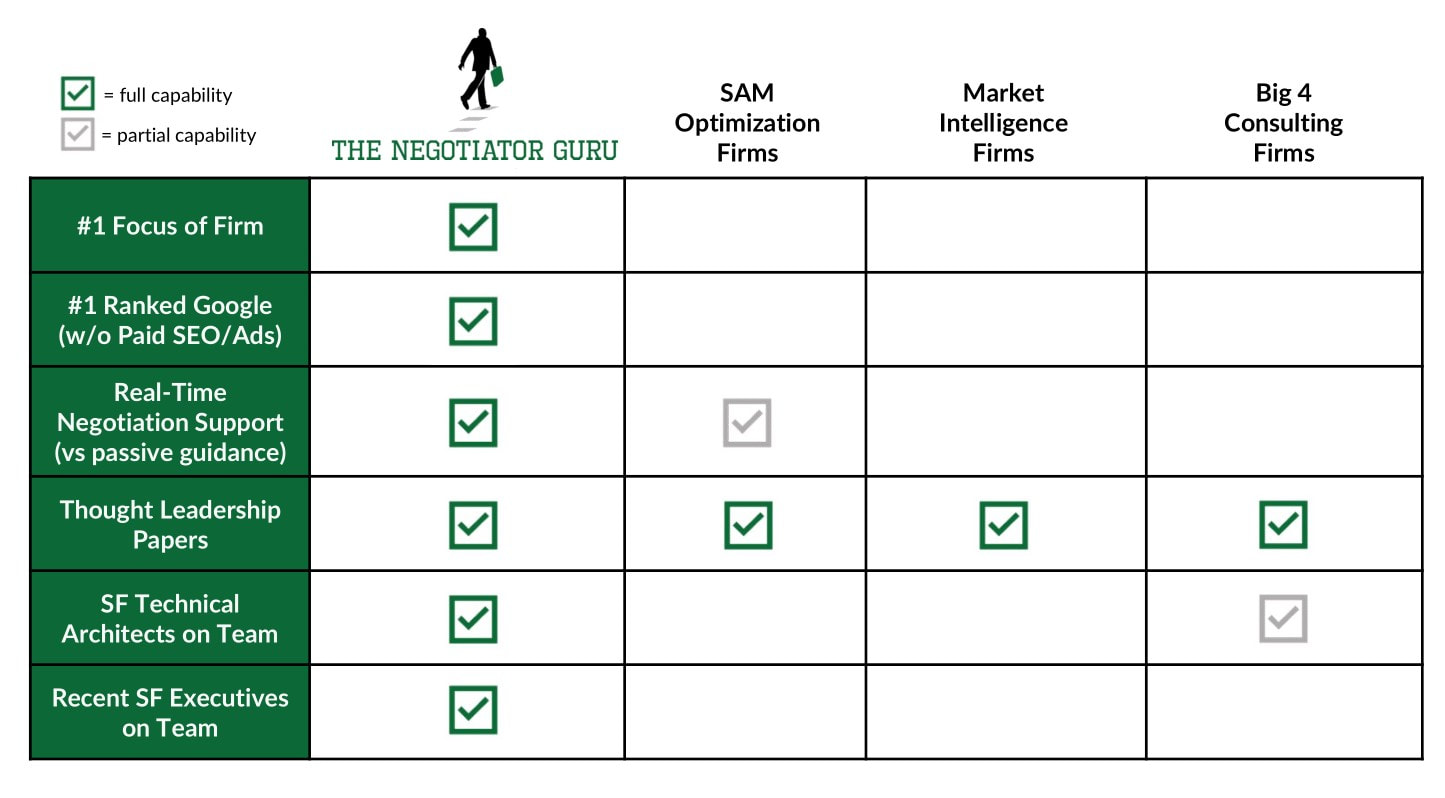

The graphic below gives a basic overview of the similarities and differences between our companies and we’ll break each one down in this article.

There Are Some Similarities Between Gartner & The Negotiator Guru

Both Gartner and TNG provide information on market and industry trends as well as general guidance on IT Cost Optimization. We have each developed our own toolkits to strategically approach each client’s needs. We overlap when it comes to providing general guidance to CIO’s.

Our companies also both provide rate benchmark data although, as you’ll read below, we go about this in different ways. Gartner has quite a bit of data they provide in aggregated terms which is useful but, without isolating the information by industry or annual spend or similar categories, it can be difficult for CIOs and their supporting functions to narrow down actionable intelligence that is defensible and realistic.

There Are Many Differences Between Gartner & The Negotiator Guru

The keyword I would use to describe the services Gartner and TNG have in common is ‘general.’ Gartner is a great resource for general information across a wide array of topics but rarely provides niche depth that our customers are longing to consume.

In contrast, TNG has a deep and disciplined focus within the IT Software vertical which enables our team to share actionable insights that are localized, specific, and highly relevant to our clients. In fact, it was our early clients that helped shaped this disciplined focus as they made their niche needs clearly known to our team. Due to our outstanding client family, TNG has been on a journey to fill our clients’ market intelligence needs for specific supplier relationships. This has organically driven our firm to be the worldwide leader in Salesforce Contract Negotiation Advisory Services which typically is 80% of our work portfolio at any given time.

With the average cost of a Gartner subscription being $30,000 per seat, plus additional consulting costs in order to receive personalized advisory services, it’s worth your while to be informed on what they can and cannot help you achieve.

Because we provide specialized data and consulting services, we’re able to dig deeper into our clients’ businesses and tailor our process to better achieve the results they’re looking for.

The following are a few of the specific areas The Negotiator Guru differs from Gartner in terms of what services and results we can offer our clients.

Right Size

While Gartner has a wealth of industry data and information, it can be nearly impossible for a client to look at the data and isolate a specific instance to best compare themselves to their peers. This leaves clients feeling informed but uncomfortable about how this information is applicable, and more importantly defensible, within their environment.

In certain circumstances, Gartner will provide “best in class” rates for a specific digital capability or service portfolio. One would argue that this provides directionally correct price targets to use as a market intelligence within their supplier negotiation. We generally agree, however, it’s important to note that your software sales executive (or worse yet your internal colleagues) will very quickly share with you that you don’t fit the profile of those rates for XYZ reason. We know this because we’ve been in these conversations on countless occasions.

In the rare case that you obtain “best in class” rate information for your specific topic of interest, you are still missing a critical piece of knowledge which we call our “Right Size” guidance. Using conservative figures, there is a 15-20% value-capture opportunity just by applying Right Size practices to your research and internal analysis before entering into any IT contract negotiation

Our supplier-specific expertise is one of the biggest contributors to this Right Sizing approach.

Within our Discovery Phase, we take an inventory of your current products and licenses and match them against your actual business needs. Almost always, we find that our clients are over licensed and have shelfware within their environment. This is an example of Right Sizing.

From a Right Pricing standpoint, not only do we understand “best in class” rates, we localize price targets based on industry, client size, and contract value. This enables our clients to feel 100% confident about the market intelligence as we’re benchmarking their rates against that of their likesize industry peers.

To expand upon this difference, we’ll use our expertise in Salesforce as an example.

As raised and validated by leading consulting and intelligence firms, TNG has the most comprehensive database of Salesforce rates in the world. This capability allows our team to quickly and easily perform a price benchmarking exercise for our clients. In many instances, we’ll inform prospective clients that their rates are within an acceptable margin of their “Right Price” benchmark and that the only real opportunity (if any) is to pursue “Right Sizing” inside of their environment. At TNG, our culture and client centric values direct our work and guide us to only accept prospective clients where we know with certainty there is a strong potential to drive huge impact.

Being able to combine Right Price and Right Size analysis will have a significant impact on the effectiveness of your supplier negotiation strategies.

Contract Language Risks

As a result of our deep supplier-specific expertise, our team on average analyzes 5 - 15 software contracts per day. As a result, we know what’s “normal” with all of the large enterprise software platforms and any common risks that are inserted unbeknownst to our clients. By doing this every single day, our team is easily able to identify commonly-used, ambiguous language that always favors the supplier.

Large software companies know their customers rarely spend time analyzing terms and conditions within their contracts. Furthermore, the widely accepted principle of Software-as-a-Service (SaaS) leads clients to believe the terms are standard and unchangeable.

Unfortunately, this simply isn’t true. As part of our Contract Execution Phase, we conduct a deep dive assessment of our client’s supplier contract as part of our standard service (another major difference from Gartner). To put the impact of this added service into context, our team identifies a unique contractual risk within SaaS contracts alone 33% of the time. If the contract we are analyzing is not a SaaS contract, contractual risks are identified, on average, 85% of the time. Knowing what to look for in each supplier’s contract language helps our clients avoid common pitfalls and supplier-centric renegotiation strategies.

Sales Playbook Coaching

Another key difference between taking a general approach on market intelligence (Gartner) vs. a software specific deep niche (TNG) is the ability to learn and leverage the sales playbook(s) for these large enterprise suppliers. It may not surprise you that within the most successful software sales organizations are repeatable and prescriptive sales playbooks that guide the near robotic actions of their sales representatives.

As a result of learning these sales playbooks we are literally able to tell our clients the moves their suppliers are going to take next. This intelligence allows us to be one step ahead within the negotiation process while leveraging the interests of both parties.

While the art of negotiation is an art and not a science, arming yourself with this intelligence allows you to deploy counterintelligence strategies inside of your organization (to counteract common supplier tactics such as divide and conquer) while also proactively preparing counterpoints to their foreseeable arguments. As a result, our clients commonly tell us that they were the most prepared they have ever been before, during, and after a negotiation.

Advisory and Execution Services

We don’t just tell you what is possible. We help you achieve it.

The biggest criticism most companies have of typical market intelligence and/or management consulting firms is that they’ll tell you what “best in class” looks like but will leave you to figure out how to achieve it within your organization. If they do offer advisory services that help you implement their “best in class” then it will be for additional fees that eat away at the cost savings potential, etc.

We’re a full, beginning-to-end provider who will help you all the way through to the execution of the contract..

At TNG, we not only share a “best in class” picture but also create a realistic future state localized for your business. We help you implement that future state while also limiting risks to your organization long after our engagement ends. This is all part of our standard duty of care for our clients.

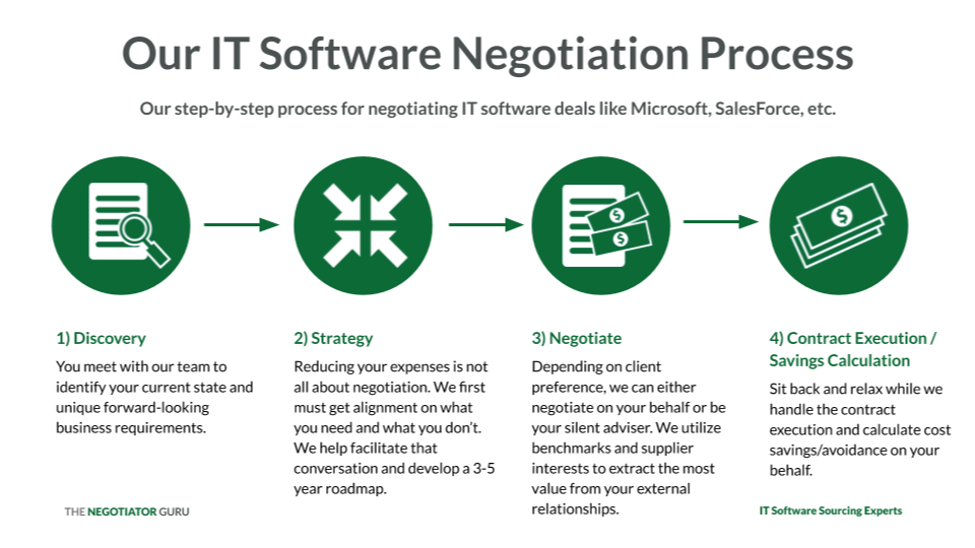

4-Step Negotiation Process

Our proprietary 4-step negotiation process allows us to deliver a clear and consistent service to our clients. In the interest of brevity we won’t go into detail of what each step entails, however, please know that within the Discovery and Strategy steps you will walk away with a forward looking roadmap as part of the overall engagement. If even offered, this would be an extra advisory fee from Gartner and/or any other market intelligence and/or management consulting firm.

The graphic below quickly outlines our negotiation process:

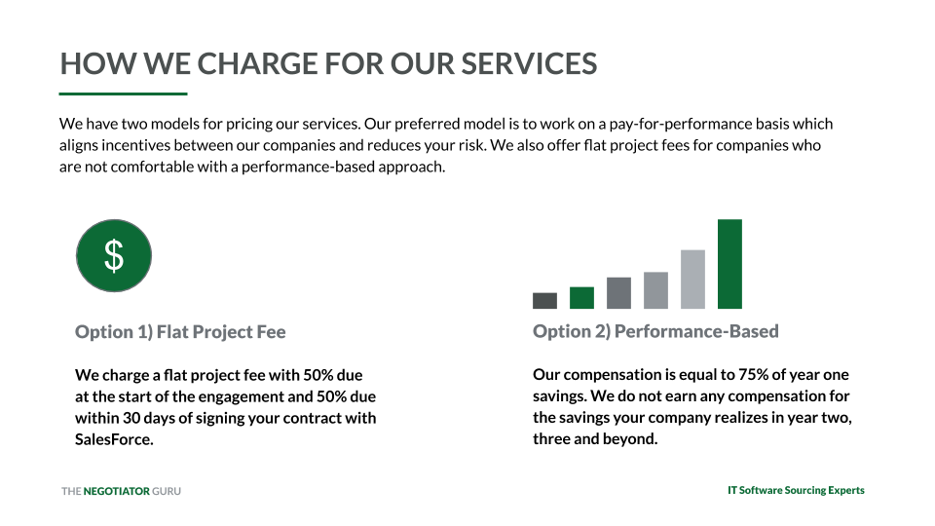

Compensation & Fees

Our compensation for these services is also entirely different from Gartner’s method.

As mentioned above, Gartner’s average subscription rate is $30,000 per person plus any additional consulting fees.

With this package, you have access to their standard publications, toolkits, and potentially a limited number of “analyst calls” which are quick conversations with the author of the publications. Any additional advisory assistance, if even possible, comes as an upcharge. Even with this additional cost, you will be on your own from an execution standpoint.

We charge either an Advisory Fee based on annual contract value or we offer a Pay Per Performance option with a simple baseline calculation.

We don’t charge based on a subscription service to our articles, we provide all this information for free.

Our rates contain no hidden charges or surprise upsells. On top of that, we’ll help you execute the strategies we develop with you.

We’re incredibly transparent with how we price our services and our clients never question the value they achieved from engaging with TNG.

Combining a Broad Overview Approach with a Specialized, Niche Consulting Firm is a Winning Equation

One of the questions we hear frequently is whether someone can/should work with both Gartner AND The Negotiator Guru.

The answer is yes!

Gartner provides a lot of good, general information. TNG helps you zoom in on the information that is most relevant to your organization so you can determine which key findings are critical for driving cost savings/avoidance while lowering your contractual risk.

Gartner is a market intelligence research firm that has a very limited advisory component separate from their articles. They do not generally provide execution services.

TNG provides information without a subscription fee and our advisory and execution services are provided in the same package.

Bringing in TNG to help you pinpoint your specific needs, value capture opportunities, and execution strategies will provide immediate and long-term intrinsic value for your organization. Remember, TNG will only accept you as a client if there is clear and distinct net positive impact potential… well, we can’t speak for the other guys.

Quid Pro Quo: Salesforce & Salesforce Consulting Partners

We commonly get asked the following questions in varying forms:

- Is The Negotiator Guru (TNG) a Salesforce Partner? Are you on the AppExchange?

- What are the differences between TNG and a Salesforce Partner?

- Why can’t my Salesforce Partner advise me on the best possible rates/products for my Salesforce environment?

Before we get into the specific answers to the above questions, let us share a brilliant unsolicited quote from one of our recent multinational clients regarding the motivational differences between TNG and a Salesforce Partner:

Expecting a registered Salesforce Partner listed on the AppExchange to give you completely impartial advice on Salesforce pricing is like expecting a court room prosecutor to share their notes with the defense before every trial.

Why, you might ask?

The answer is simple: All Salesforce Consulting Partners have an unavoidable conflict of interest with their clients. Why? Because of the inherent need for these “Partners” to make both their client and Salesforce happy.

In this article we’re going to cover this conflict of interest and why TNG is different.

Salesforce Partners Always Have Two Clients (and one isn’t you)

Salesforce Partners have two customers:

- You the client; and,

- Your Salesforce account management team (hereby collectively referred to as “Salesforce”)

The fact of the matter is that your Salesforce Partner is, by design, incentivized to keep both its client and Salesforce happy. The difficult truth is that you, the customer, are the least important of the two clients. Yes indeed, more often than not, your Salesforce Partner has a greater long-term interest in keeping Salesforce happy. Yes, we know this sounds horrible, but we hope you appreciate our directness here.

Let’s dig into two key, but interrelated, reasons:

1. Business Relationships

Your Salesforce Partner focuses heavily on keeping a strong business relationship with Salesforce. Why? Because Salesforce is their single most effective sales channel to acquire new business. When Salesforce identifies a new or existing client that needs custom development work, they have the entire Salesforce Partner community to consider when providing a recommendation to their customer. Naturally, those Salesforce Partners that are “supportive” to their sales process will be referred more and more business.

2. Money

More referrals = more business = more money.

Back in the 18th century Edmund Burke once said “…never bite the hands that feed you.”

Presenting this differently, if you were a Salesforce Account Executive and you had a Salesforce Partner repeatedly suggest changes to an account that materially decreased your sales compensation revenue, would you continue using that Partner when you have others options available?

To be clear; we are not saying that all Salesforce Account Executives are unethical in how they conduct business. However, we are stating that there is an inherent fundamental conflict of interest for the Salesforce Partner who commercially needs to appease both parties.

The unfortunate situation is that while a Salesforce Partner may know a customer is being sold more products and/or services than they actually need, they rarely speak up for the reasons above. We’ve even been told there is an informal blacklist inside of Salesforce that keeps track of these Partners that raise cost avoidance opportunities during the sales process.

We don’t like writing about this topic but we know every customer wants the truth.

Why TNG is different

Quite simply we are only focused on keeping you, the client, happy. When the firm was founded we only included a “pay for performance” compensation option to ensure our incentives were aligned with the client. Over the years, we added an “advisory fixed fee” option purely based on repeated client requests.

TNG’s Right Size & Right Price Process

Part of our secret sauce is a deep focus and understanding on 1) how Salesforce works, 2) you as a customer, and 3) best practices on how to quickly drive savings in your environment. While strategic negotiation is an art, our Right Size & Right Price process is more of a science based on its repeatability across all industries.

The Right Size process

focuses on identifying consumption based savings opportunities within your organization.

Our three most commonly identified opportunities within this process are:

- “shelfware” elimination

- license optimization

- governance enhancement. On average, we identify 24% savings opportunity within this process alone.

The Right Price process purely focuses on your product and service price points within your specific Salesforce contract. The vast majority of our clients reach out to us for this service alone. Specifically, they want to know how their prices compare to their peers and if they’re getting a “good deal.”

We have the largest database of Salesforce rates in the world and can quite easily identify if there is a price optimization opportunity within your various SKUs. Unlike other large market intelligence firms, we are able to isolate your realistic “should cost” price points based on your industry, annual revenue, and annual contract value. The others simply will share a “best in class” rate which is ambiguous and often self-serving.

On average, we identify a 22% savings opportunity here but your specific opportunity could be as high as 305% (yes, this was a real client).

Fit-for-Purpose Engagement Style

The Founder of TNG, Dan Kelly, feels strongly about providing our clients options on how they engage our firm depending on each individual client’s needs. Some clients want a “negotiation-as-a-service” approach while others simply want the output of our Right Price process to identify target price benchmarks to use within their own negotiations. We welcome you to start a conversation with our firm to determine how we can most effectively and efficiently support you.

Summary

To recap, here are the basic points of what we’ve covered in this article:

- Your Salesforce Partner has motivation to keep both you and Salesforce happy;

- They aren’t able to easily share cost savings opportunities with you in fear of losing future opportunities with other Salesforce customers;

- The Negotiator Guru is only focused on driving cost savings for you by negotiating with Salesforce, the client;

- We have a proprietary negotiation process that includes both the art of negotiation and the science of opportunity creation inside of your Salesforce organization,

- On average, we save clients 20-50% on their Salesforce annual expenses through our Right Size and Right Price process; and,

- On SELA Agreements (Salesforce Enterprise License Agreement), we typically generate a 41.3% savings for our clients.

- We only accept clients within our full negotiation service where we know we can make a huge impact.