Quid Pro Quo: Salesforce & Salesforce Consulting Partners

We commonly get asked the following questions in varying forms:

- Is The Negotiator Guru (TNG) a Salesforce Partner? Are you on the AppExchange?

- What are the differences between TNG and a Salesforce Partner?

- Why can’t my Salesforce Partner advise me on the best possible rates/products for my Salesforce environment?

Before we get into the specific answers to the above questions, let us share a brilliant unsolicited quote from one of our recent multinational clients regarding the motivational differences between TNG and a Salesforce Partner:

Expecting a registered Salesforce Partner listed on the AppExchange to give you completely impartial advice on Salesforce pricing is like expecting a court room prosecutor to share their notes with the defense before every trial.

Why, you might ask?

The answer is simple: All Salesforce Consulting Partners have an unavoidable conflict of interest with their clients. Why? Because of the inherent need for these “Partners” to make both their client and Salesforce happy.

In this article we’re going to cover this conflict of interest and why TNG is different.

Salesforce Partners Always Have Two Clients (and one isn’t you)

Salesforce Partners have two customers:

- You the client; and,

- Your Salesforce account management team (hereby collectively referred to as “Salesforce”)

The fact of the matter is that your Salesforce Partner is, by design, incentivized to keep both its client and Salesforce happy. The difficult truth is that you, the customer, are the least important of the two clients. Yes indeed, more often than not, your Salesforce Partner has a greater long-term interest in keeping Salesforce happy. Yes, we know this sounds horrible, but we hope you appreciate our directness here.

Let’s dig into two key, but interrelated, reasons:

1. Business Relationships

Your Salesforce Partner focuses heavily on keeping a strong business relationship with Salesforce. Why? Because Salesforce is their single most effective sales channel to acquire new business. When Salesforce identifies a new or existing client that needs custom development work, they have the entire Salesforce Partner community to consider when providing a recommendation to their customer. Naturally, those Salesforce Partners that are “supportive” to their sales process will be referred more and more business.

2. Money

More referrals = more business = more money.

Back in the 18th century Edmund Burke once said “…never bite the hands that feed you.”

Presenting this differently, if you were a Salesforce Account Executive and you had a Salesforce Partner repeatedly suggest changes to an account that materially decreased your sales compensation revenue, would you continue using that Partner when you have others options available?

To be clear; we are not saying that all Salesforce Account Executives are unethical in how they conduct business. However, we are stating that there is an inherent fundamental conflict of interest for the Salesforce Partner who commercially needs to appease both parties.

The unfortunate situation is that while a Salesforce Partner may know a customer is being sold more products and/or services than they actually need, they rarely speak up for the reasons above. We’ve even been told there is an informal blacklist inside of Salesforce that keeps track of these Partners that raise cost avoidance opportunities during the sales process.

We don’t like writing about this topic but we know every customer wants the truth.

Why TNG is different

Quite simply we are only focused on keeping you, the client, happy. When the firm was founded we only included a “pay for performance” compensation option to ensure our incentives were aligned with the client. Over the years, we added an “advisory fixed fee” option purely based on repeated client requests.

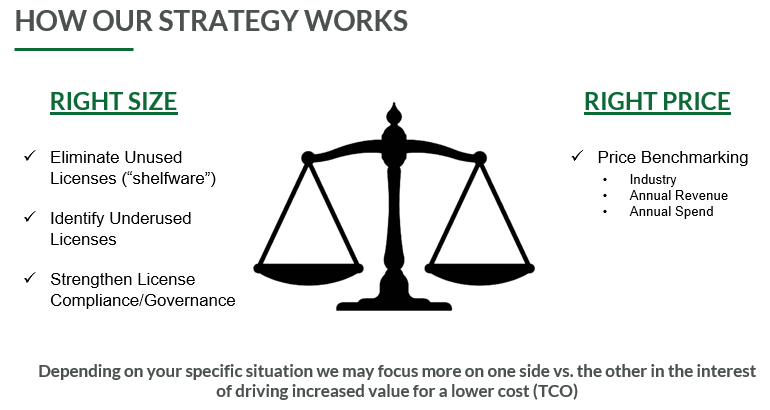

TNG’s Right Size & Right Price Process

Part of our secret sauce is a deep focus and understanding on 1) how Salesforce works, 2) you as a customer, and 3) best practices on how to quickly drive savings in your environment. While strategic negotiation is an art, our Right Size & Right Price process is more of a science based on its repeatability across all industries.

The Right Size process

focuses on identifying consumption based savings opportunities within your organization.

Our three most commonly identified opportunities within this process are:

- “shelfware” elimination

- license optimization

- governance enhancement. On average, we identify 24% savings opportunity within this process alone.

The Right Price process purely focuses on your product and service price points within your specific Salesforce contract. The vast majority of our clients reach out to us for this service alone. Specifically, they want to know how their prices compare to their peers and if they’re getting a “good deal.”

We have the largest database of Salesforce rates in the world and can quite easily identify if there is a price optimization opportunity within your various SKUs. Unlike other large market intelligence firms, we are able to isolate your realistic “should cost” price points based on your industry, annual revenue, and annual contract value. The others simply will share a “best in class” rate which is ambiguous and often self-serving.

On average, we identify a 22% savings opportunity here but your specific opportunity could be as high as 305% (yes, this was a real client).

Fit-for-Purpose Engagement Style

The Founder of TNG, Dan Kelly, feels strongly about providing our clients options on how they engage our firm depending on each individual client’s needs. Some clients want a “negotiation-as-a-service” approach while others simply want the output of our Right Price process to identify target price benchmarks to use within their own negotiations. We welcome you to start a conversation with our firm to determine how we can most effectively and efficiently support you.

Summary

To recap, here are the basic points of what we’ve covered in this article:

- Your Salesforce Partner has motivation to keep both you and Salesforce happy;

- They aren’t able to easily share cost savings opportunities with you in fear of losing future opportunities with other Salesforce customers;

- The Negotiator Guru is only focused on driving cost savings for you by negotiating with Salesforce, the client;

- We have a proprietary negotiation process that includes both the art of negotiation and the science of opportunity creation inside of your Salesforce organization,

- On average, we save clients 20-50% on their Salesforce annual expenses through our Right Size and Right Price process; and,

- On SELA Agreements (Salesforce Enterprise License Agreement), we typically generate a 41.3% savings for our clients.

- We only accept clients within our full negotiation service where we know we can make a huge impact.

More resources

From Fortune 500 giants to fast-growing innovators, TNG has helped clients save 20% – 40%+ on enterprise software contracts — even when they thought it was impossible

3 Strategies to Elevate Your Software Supplier Relationship

Over the years, our TNG client family has requested more and more guidance related to managing and elevating their commercial supplier relationships. Within this article, you’ll find our top 3 proven strategies to transform IT supplier relationships from tactical to strategic.

Strategy #1 – Control the Flow

When we say “control the flow”, we’re referring to conversation, meeting, and engagement flow.

When prospective clients reach out to TNG, they almost always have the complaint that the supplier knows more about the “needs” of their organization than they do. This most typically is due to the internal lack of time and/or resources to focus on a specific supplier or digital capability. On the other hand, the supplier’s sales team is laser focused on opportunities to grow their business inside of your organization. Immediately, this creates an unfair environment for all parties involved.

You may be thinking that this only creates an unfair advantage for you, the customer. Well, in most situations that’s true. However, it should also be noted that in some circumstances, the supplier’s sales team may be operating with good intentions and simply answering your internal stakeholder’s demand for attention. In short, when one side knows more than the other, it creates an uncomfortable situation for at least one party.

As our team brings 100+ years of collective experience, we have seen just about everything. Most of TNG’s clients are very well-established companies that have $5 billion+ in annual revenue. These companies typically have a “center of excellence (COE)” and/or a “software asset management (SAM)” team. While the overall intent is good, we typically see only about 10% of our clients leveraging these teams of resources correctly.

What happens to the other 90%? Well, one of the most classic inside sales techniques is for a supplier’s sales team member to establish, chair, and/or participate in a COE with a specific focus on their software and its many digital capabilities. This type of group typically meets either monthly or quarterly and is sold as a way in which the sales team member can “inform” the COE/SAM team members of the “demand” coming from inside of the organization. The reality is that the “demand” is often created by the sales team member who has been pushing a land-and-expand strategy inside of the organization.

The easiest way to not only level the playing field with your software suppliers, but also elevate the relationship from tactical to strategic, is to set up strict governance around the overall engagement. Every supplier engagement is slightly unique, but we recommend focusing on the following core tenants:

- Focus your efforts on your Top 10 software suppliers.

- Develop a steering team of executive IT leaders that are in control of the Digital Capability strategy for your company.

- Develop an internal COE for each of your Top 10 suppliers. The size and scope of them should proportionally match the importance of the supplier’s impact on your business.

- Identify and assign clear roles & responsibilities for each employee team member that is part of their performance objectives.

- Do not allow supplier sales team members to be a member of the core team but rather serve as an invited guest on a routine cadence.

This is about the time where traditional sales team members will indicate that this approach will slow down process, innovation, growth, etc. The reality is quite the opposite when properly set up and managed. The primary outcomes you want to achieve are the following:

- Shift the communication paradigm from outside-in to inside-out. This allows the company to ideate, contemplate, and organically socialize a software roadmap (vs. constantly asking the supplier for a list of their asset inventory).

- Share information with suppliers only when it has been fully vetted and approved as a sanctioned project or approved proof of concept. If done properly, this drastically decreases the chance of duplicate purchasing, split requirements, and/or random unwarranted proof of concepts (that usually turn into shelfware) around the enterprise.

- Allow everyone to be more efficient and structured with their time by eliminating the need for follow-up meetings, etc. In other words, engaging suppliers only after decisions have been made internally by the COE will enable the COE to be treated as a true authoritative entity vs a “check the box” exercise.

- Provide opportunities for suppliers to suggest innovative solutions in a fully committed environment.

We find that our TNG clients save an average of 26% annually by deploying this strategy alone (with our help, of course).

Strategy #2 – Manage Upwards

Anyone who knows the basics of selling understands that the easiest way to make a sale is to identify and influence the decision-maker directly. For large enterprise sales teams who are managing multi-million-dollar contracts, that decision-maker is very often an executive leader within the company. Far too often, we find that organizations provide unfettered access to executives without reason. This, in short, usually enables a very unhealthy and complacent comfort for the supplier sales team that (if not properly managed) rarely produces intrinsic value for the company.

By far one of the most effective ways to elevate your supplier relationship is to set up strategic business discussions between company and supplier executives. The key here is to establish equal representation on both sides and ensure there is proper attention and respect established between both companies. Access to your company’s executives should largely be restricted to these meetings which, where possible, should be set up by the COE/SAM teams mentioned in Strategy #1.

Subsequently, it’s important to know that you can leverage access to your executives to exemplify to a new supplier that any new proof of concept, tool, etc. will be given the highest level of attention and visibility. This means a lot for any supplier (new or existing) as it ensures the right eyes are engaged.

Strategy #3 – Set Realistic Milestones that are Mutually Achievable

Just as employees like to understand their performance objectives for each year, it has been proven by TNG that suppliers who understand what “great looks like” outperform those that are not given clear business objectives. Nearly everyone in the business world understands the concept of milestones; however, the implementation of the methodology is highly inconsistent.

One of the many mistakes companies make when establishing a milestone-based contract is they make the actual milestones either ambiguous or unrealistic. Both are equally as dangerous. Ambiguity allows everyone to be right and wrong at the same time. Unrealistic milestones, if accepted by the supplier, often induce unhealthy behaviors by those chartered with meeting or exceeding the same. It doesn’t take much to set a once “strategic” relationship on a path to implosion with either of these scenarios.

Establishing realistic milestones is important for your suppliers. Everyone, at every age, enjoys accomplishing a goal. It’s important to recognize this fact since at the end of the day, as this is a human reaction, and well, we’re all human.

To learn how to properly set up a milestone plan and/or implement any other strategies mentioned above that drive performance for both the company and the supplier, here’s a hint: It’s not just the supplier that has performance milestones!